The Best Strategy To Use For Insurance Brokerage

(ANZIIF) Certified Insurance Policy Professional (CIP) and also National Insurance Brokers Association (NIBA) Certified Exercising Insurance Coverage Broker (QPIB) credentials.

, or straight by a federal government body., insurance brokers have self-governing bodies responsible for licensing as well as policy.

— Cloud Links have a peek at this website (@ldcloudlinks) Get More Information December 20, 2022find this

In order to get a broker's permit, an individual usually needs to take pre-licensing programs and also pass an examination. An insurance broker additionally should submit an application (with an application cost) to the state insurance coverage regulator in the state in which the applicant desires to do organization, who will establish whether the insurance coverage broker has actually fulfilled all the state requirements and will normally do a history check to figure out whether the applicant is considered credible and also competent.

The Insurance Brokerage Statements

Some states additionally call for applicants to submit fingerprints. A lot of states have reciprocity contracts wherein brokers from one state can end up being quickly licensed in an additional state.

A state might revoke, suspend, or refuse to renew an insurance policy broker's certificate if at any type of time the state determines (generally after notification and also a hearing) that the broker has actually involved in any kind of activity that makes him unreliable or inept. (CGL) insurance coverage plan that left out insurance coverage for the "home entertainment service".

The Insurance Brokerage Ideas

In most states, representatives can not charge a cost in enhancement to their compensation, although Texas is one of the exemptions - Insurance Brokerage. Not an outright splitting up; an insurance policy agent is an insurance policy business's agent using agent-principal lawful personalized. The agent's key partnership is with the insurance service provider, not the insurance policy buyer.

This can have a considerable useful impact on insurance policy settlements acquired through a broker (vs. those obtained from an agent). Anyone serving as an insurance policy representative or broker should be accredited to do so by the state or jurisdiction that the individual is operating in. Whereas states previously would provide different licenses for representatives as well as brokers, most states currently release a single producer permit regardless if the individual is acting on part of the insured or insurance provider.

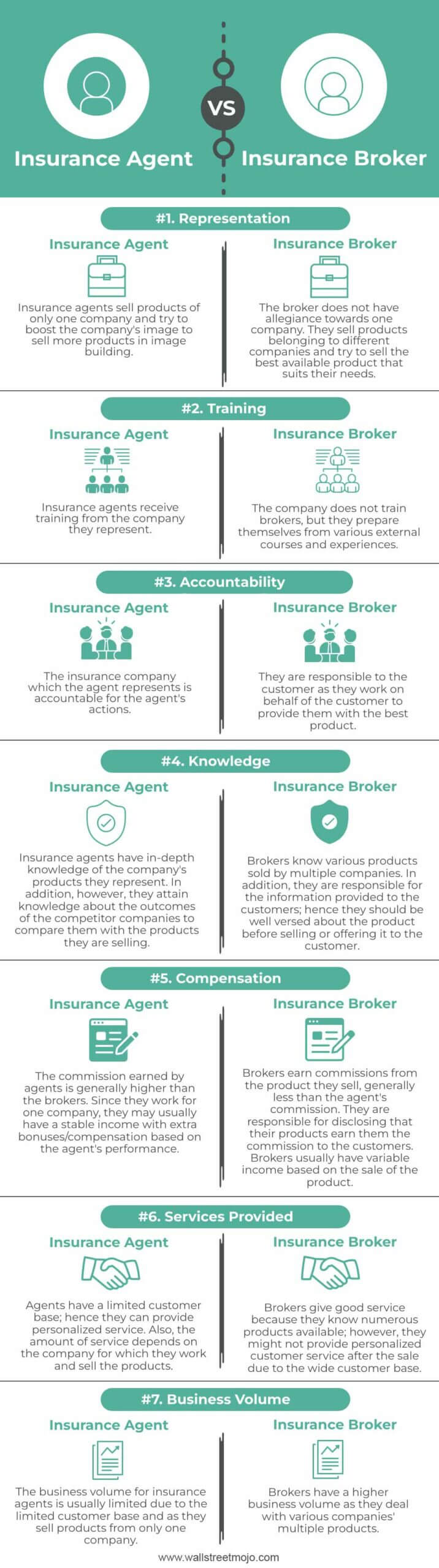

While both representatives and also brokers function as intermediaries between insurance customers and also the insurance coverage market, and also can use insurance policy quotes on various plans, there are two vital differences between both: Agents stand for insurance firms, while brokers represent the client. Agents can complete insurance coverage sales (bind coverage), while brokers can not. While brokers search for policies from several different carriers, an agent needs to offer plans from several of the insurance suppliers that they stand for.

The Ultimate Guide To Insurance Brokerage

Brokers commonly play even more of an advising duty in discovering coverage than agents, because brokers have a responsibility to represent the most effective passions of the customer. Brokers analyze a number of plans as well as advise certain insurance coverages from various business, however then must resort to a representative or an insurance policy service provider to have a selected policy bound to a customer - Insurance Brokerage.

When acquiring insurance policy, it's clever to obtain quotes from numerous insurance firms to discover the most effective rate. While virtually anybody can compare rates on-line, sometimes it makes sense to have a specialist walk you via your options. Easily contrast customized prices to see just how much changing cars and truck insurance coverage can save you.

Armed with both your history as well as their insurance coverage expertise, they can locate a plan that best fits your needs for a reasonable rate. While brokers can save you money and time, you might need to pay a broker charge for their services - Insurance Brokerage. Despite the cost, you may spend much less general.

What Does Insurance Brokerage Do?

Need insurance for a company. Maintain in mind, if you're acquiring irreversible life insurance policy, it's ideal to speak with a fee-only financial expert (much more on this later).